Tesco bank

How can we rapidly assess the viability and desirability of a new financial service?

Lead Product Strategist December 2020 - February 2021

📢 Client challenge: The COVID-19 pandemic has profoundly reshaped how people manage their finances and daily lives, including savings, household budgeting, and investments. In 2021, Tesco Bank sought assistance in exploring digital financial services, prioritising a user-centred approach to help customers navigate these evolving challenges while ensuring the bank's competitiveness.

📁 Responsibilities: Conducted a comprehensive investigation to evaluate the desirability and feasibility of introducing additional digital services to the client's existing customer base. Activities included facilitating surveys, interactive sessions with focus groups, and in-depth interviews with customers to gather insights into their financial needs. Conceptual prototypes were designed to test the service hypotheses with users to fine-tune the proposed solution. Supported business analysis activities to align with the client’s strategies and existing processes and systems.

🛠️ Tools: Miro | Sketch | Invision

Client Challenge

Why have we chosen to recommend these particular financial services?

Tesco Bank has been a steadfast provider of conventional banking services for many years, offering its customers a wide range of products and services, including savings accounts, loans, and mortgages. However, with the intensifying competition in the financial sector and the constantly evolving customer demands, Tesco Bank acknowledged the need to adapt and introduce innovations to remain competitive. The COVID-19 pandemic has significantly altered how people handle their finances and day-to-day lives, giving Tesco Bank a unique opportunity to offer additional services that could assist its customers in navigating these new challenges.

To respond to these changes, Tesco Bank explored the possibility of offering innovative financial services to its customers. With the help of KPMG, the bank generated several hypotheses, including the feasibility of providing services like switching utility providers, boosting savings, insurance comparison, and wealth management. This project aimed to help Tesco Bank's customers better manage their finances and improve their overall financial well-being.

Approach

How can we conduct a dependable research sprint to test our services with users?

A series of workshops, design and research sessions to uncover the desirability, viability and feasibility of new financial services

In partnership with the KPMG Customer team, we strategically divided the project into four phases: user research, hypothesis formation, prototype creation, and customer testing sessions. Our user research phase comprised qualitative and quantitative research methods, such as surveys, focus groups, and interviews, to gain a deep understanding of the needs and expectations of our target customers. For the design phase, we gathered feedback and refined our offerings through rapid prototypes of the proposed services and small-scale customer testing sessions.

User Research

We utilised a blend of qualitative and quantitative research methods to understand our target customers comprehensively. This encompassed surveying 500 customers, participating in 1.5-hour interactive focus group sessions, and conducting in-depth interviews with various customers. These valuable insights formed the basis for our service hypotheses.

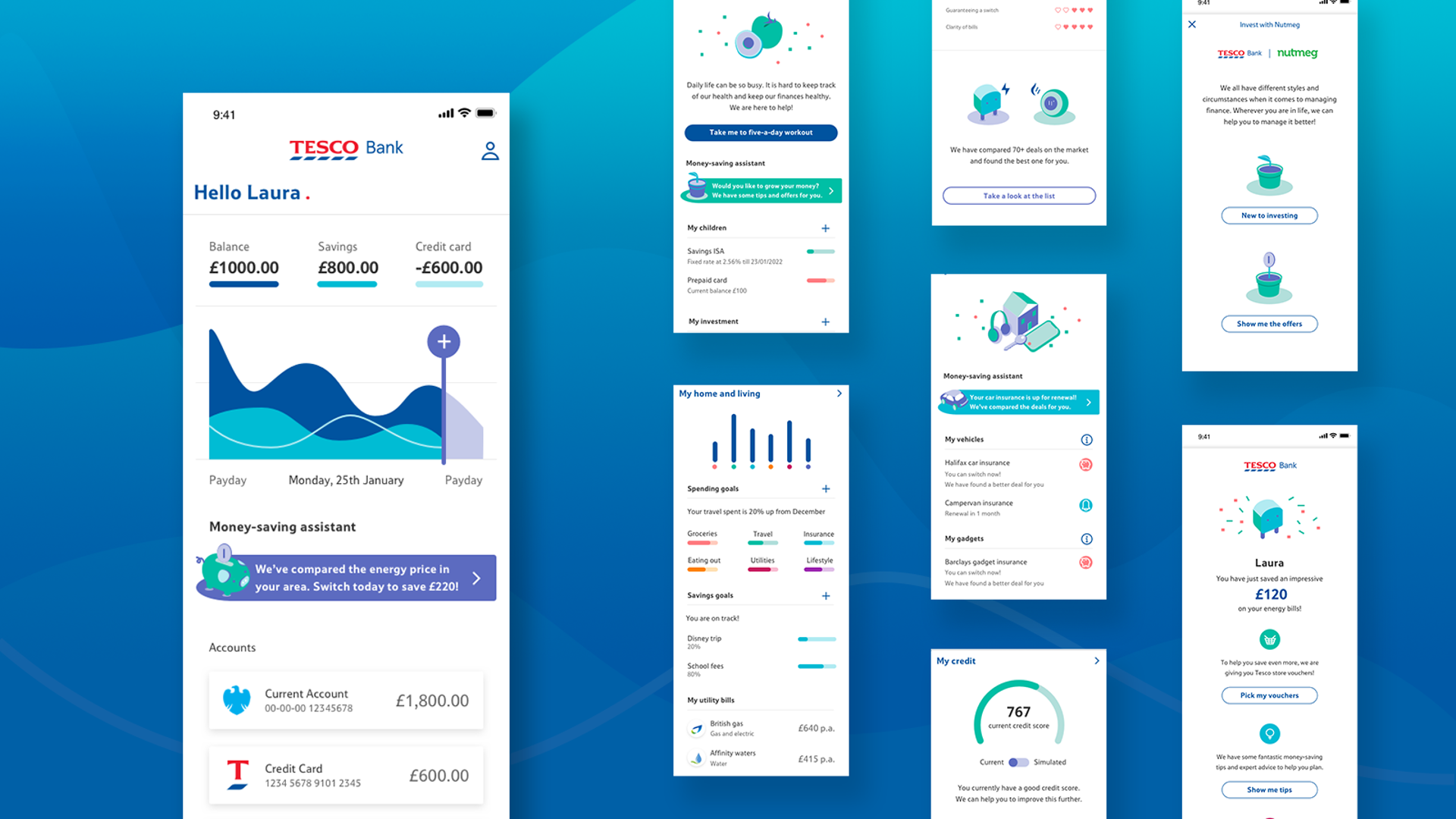

Interaction Design

I designed intuitive, consistent, accessible interactions among users, services, and products. I analysed user needs for new features, such as energy-switching services, and implemented pre-population to simplify the savings process. I have utilised micro-animations to provide feedback for actions, designed reward mechanisms, and incorporated gamification, such as a 'Five-a-day financial workout,' to encourage positive behavioural changes.

Content Design

Inclusive design was our top priority. Therefore, we trimmed jargon, employed clear and concise language, and simplified complex information based on our research. These efforts rendered the content more accessible and streamlined the user experience for financial decision-making. We conducted continuous testing of our prototypes with ongoing content updates.

Business Analysis

We worked closely with third-party providers and Tesco Bank, ensuring the services aligned with their strategies and functioned by their processes and existing systems. We modelled financial service scenarios and revenue flow forecasts to prioritise the backlog based on value and ROI (Return on Investment).

Ecosystem mapping

Outcome

What have we delivered?

The project results were overwhelmingly positive, demonstrating a high desirability and feasibility for the proposed new financial services. The extensive research, design, and testing phases showed that the benefits could provide a competitive advantage for Tesco Bank while enhancing customer satisfaction and loyalty. The prototypes we developed and tested were met with great enthusiasm by the customers who participated, praising the services for their simplicity and ease of use.

A promotional video was also created to showcase the new services and highlight the research findings that were well received by the leadership team, effectively communicating the benefits of the services in an engaging and memorable manner.